Let’s admit it, at some point, it has crossed our minds having paid your insurance premiums for so many months and years we have asked ourselves, how much do insurance companies pay in claims? Or how many times have we “heard” statements that insurance companies don’t pay claims? What are these statements based on? Facts, emotions, a disgruntled customer or frustration?

Over the years I have seen media covering stories where a client’s claim has been declined. How many stories have the media covered on how much claim the Life insurance industry has paid?

Life or Health insurance is not only about finding or paying the cheapest premiums, as the saying goes “you get what you pay for”. Unfortunately when we apply our DIY mentality when it comes to life insurance, the only thing clients have access to is pricing mechanism. So naturally you will select the quote which shows you the cheapest premium option. I mean if an apple here costs $1 and an apple in the other corner costs $2, of course I would only want to spend a $1. But is it apples for apples when you are comparing life and health insurance premiums?

One of the key benefits of having an insurance broker or advisor is their ability to understand your financial risks and putting together a plan that will deliver at time of claim.

When you work with your insurance broker, they not only compare your premiums; but more importantly the quality of the products ie is it apples for apples and the Claims history of the insurance company.

Numbers don’t lie:

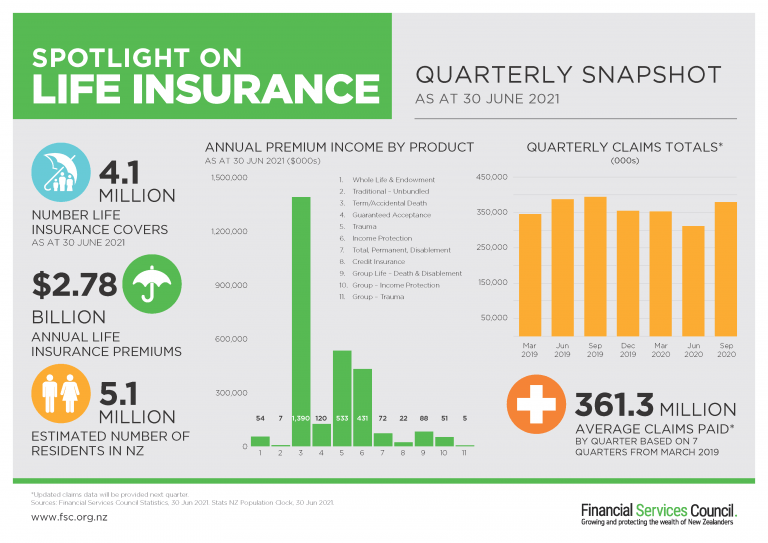

(Here is the industry statistics of the insurance claims paid as at 30 June 2021 (source: Financial Services Council)).

The life insurance industry has paid an average of over $361 million over the last 7 quarters since March 2019. That is a staggering average of $1.445 billion dollars paid in claims in a year by the life insurance industry. This is a combination of different products and claims at play here such as Life Cover, Trauma Cover, Income Cover and Total & Permanent Disability Cover.

While the total claims pay out might seem large, Underinsurance remains a key issue in New Zealand. A recent survey by the FSC* showed 35% of Kiwis would consider taking advice, but only 18% actually receive it.

So how are those clients who don’t seek advice setting up their insurances? What research have they used? Have they compared the product features with another provider? How much of the comparison have they actually understood? Or have they walked into the bank and obtained their insurance over the counter? Have the bank done a comparison on how their product is better than the bank down the road, let alone compare against a major provider? Has the client been provided any claims history?

A closer look at claims:

What are some of the most common health conditions for claim? Lets look at a few major insurance providers namely Partners Life, AIA NZ and Fidelity Life.

- Cancer

Neoplasm or Cancer account for 30% – 50% of Life Cover claims, between 24% – 59% of Trauma Cover claims and between 14% – 20% of Income Cover claims as seen in the claims stats provided by Partners Life, AIA & Fidelity Life. The stats on Income Cover shown are far less but this could also be because not a lot of Kiwis insure themselves for Income Cover.

Furthermore approximately 18% of Medical cover claims are related to cancer. Advances in cancer care has enabled many more aspects of treatment and diagnosis to be managed privately.

1 in 3 people in NZ are affected by cancer, whether it’s a friend or family member who’s been diagnosed.

- Cardiovascular Disease

Heart diseases make up 15% – 20% of Life Cover claims, 16% – 20% of Trauma cover claims and approximately 10% of Income Cover claims. Cardiovascular claims are associated in various types such as Heart attacks, Heart failure & claims associated with Ischaemic Heart disease.

- Mental Health

Given it is Mental Health Awareness week; it is a timely reminder to reflect just how many mental health related claims come through to insurers. Around 24% of Income Cover claims are paid annually by insurance companies. Mental health can have a very long impact on the client’s ability to return to work and earn an income. Trauma cover or Medical Cover does not necessarily have coverage for mental health, hence not included in their stats. This is another reminder for clients to consider protecting their ability to earn by looking into Income cover insurance.

What next?

Work with an Insurance broker to ensure you are fully aware of the different products available in the market. Ask your insurance broker or insurance company about their claims philosophy, statistics before you sign the dotted line.

If you have any questions or wish to know more, please feel free to contact Halo Advisers Limited who are insurance advisors based in Auckland at +64212161200 or email us at avi@coconutinsurance.co.nz.